Nowadays, every conference, event, and forum across the globe seems to have some discussion on SMEs and how to resolve the challenges they face in global markets – and for good reason. SMEs contribute immensely to employment generation, manufacturing, capital formation, and trade, making them vital to any domestic economy.

When it comes to trade, one of the major challenges that SMEs face is late payments from their suppliers, which increases the need for costly working capital. Around the world, countries are taking their own approaches to tackle this: often, legally binding buyers to a specific time within which payment must be made, for the goods supplied or services rendered.

But in actuality, these laws are difficult to implement, and many prove ineffective in practice.

India turns to digital platforms

This was the case in India too – small businesses critical to the economy were struggling because they couldn’t get paid by their buyers on time, despite government legislation.

To resolve this issue, the Reserve Bank of India (RBI) proposed a digital trade receivable discounting marketplace for SMEs in March 2014: marking the beginning of the Trade Receivable Discounting System (TReDS) platforms in India.

After an elaborate evaluation process and drafted guidelines, the RBI gave three entities licenses for building and operating the TReDS. The platforms went live in 2017 and were the first instance of a digital marketplace being regulated by the financial regulator of the country.

Both the RBI and the Indian government have taken various measures to support the platforms. Some of the significant steps taken by RBI are:

- Creating a special clearing window dedicated to settling transactions that originated on the TReDS platforms.

- Ensuring that KYC and AML done by the TReDS platforms are accepted by the Banks and non-bank factors.

- Providing a transparent price discovery mechanism through a unique auction process.

- Introducing the master agreement concept between participants and the TReDS platform (which eliminates the need for bilateral agreements between participants).

- Integrating TReDS entities with the central registry for the registration of factoring units.

- Allowing TReDS platforms access to the central KYC (CKYC) registry.

- Ensuring that exposure through TReDS is considered part of priority sector lending by the banks.

The Indian government has also supported the platforms by making registration on TReDS platforms compulsory for all central public sector enterprises, and for all business entities with turnover greater than $30 million. They have also implemented appropriate changes in the Factoring Regulation Act to align with workflows on TReDS platforms.

TReDS: seven years and growing

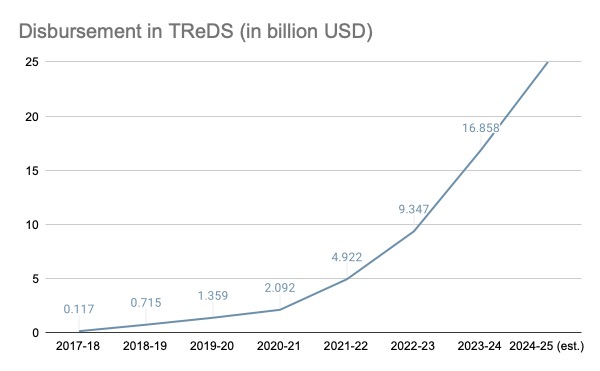

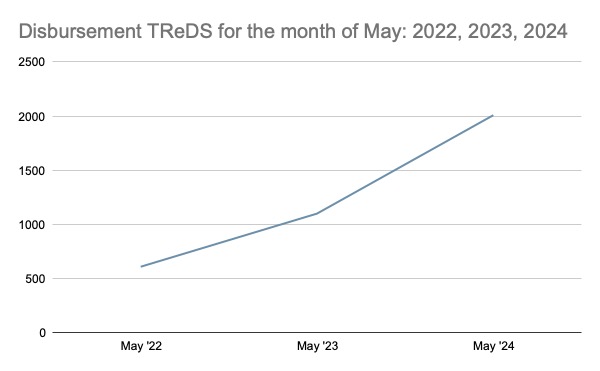

Over the last seven years, the three TReDS platforms have experienced consistent growth.

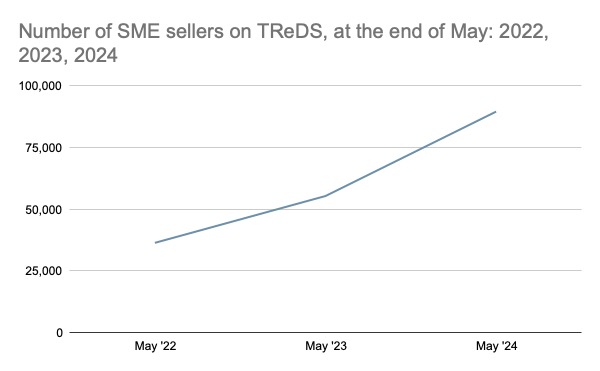

Together, the three platforms are expected to reach a throughput (i.e. total amount discounted) of $25 billion in FY 2024-25, with around 90,000 SME sellers, 5,000 buyers, and 50 financiers. The combined short-term trade asset base is expected to exceed $6 billion.

The TReDS model has also proven to be commercially viable, with all three platforms being cash-positive. Based on market information, delinquencies sit at 0.2%. Making credit insurance available which is aligned with the TReDS workflow can more than double present volumes. This would increase liquidity and encourage financiers to invest more in short-term trade assets – ultimately benefiting SMEs.

The TReDS ecosystem has contributed significantly to the short-term working capital finance ecosystem for SMEs in India. Some of the contributions include:

- Proving how digital platforms can resolve complex financing challenges in the B2B space.

- Creating innovative auction-based price discovery, which reduces borrowing costs.

- Removing collateral and recourse to the seller to better align with the needs of SMEs.

- Minimising costs for financiers to get a granular self-liquidating portfolio.

- Extending the usance period for buyers to align their working capital cycle.

- Promoting widespread adoption of factoring as a financing tool.

- Maximising security by allowing integration with the ERP systems of all participants.

- Eliminating geographical or time constraints by making the platform accessible from anywhere at any time.

- Removing scalability constraints in terms of liquidity and volume of business.

IFSCA launches cross-border trade finance platform

in GIFT City

With TReDS’s successful implementation in the domestic market, a new digital cross-border platform is gaining traction under the watchful eyes of the International Financial Services Centres Authority (IFSCA).

IFSCA – the unified financial regulator in Gujarat International Finance Tec-City (GIFT City) special economic zone in India – calls these new digital cross-border platforms ‘International Trade Financial Services (ITFS) Platforms’.

GIFT City is being developed as a global financial and IT services hub – a first of its kind in India – and is designed to be at par with globally benchmarked financial centres worldwide. GIFT City’s master plan facilitates a multi-service special economic zone with International Financial Services Centre (IFSC) status, a domestic finance centre, and the associated social infrastructure.

ITFS is the electronic platform that provides trade finance services at the IFSC. It facilitates cross-border trade financing through a bidding mechanism to global buyers and sellers; financial institutions in India and abroad are participating.

IFSCA issued four licenses to build and operate the ITFS Platforms. Three have been commercially live as of July 2023, and the fourth has completed the regulatory sandbox.

The ITFS platforms gaining traction amongst buyers, sellers, and financial institutions: over 15 factors and banks are already transacting on the platforms.

Opportunities and challenges for ITFS platforms

Compared to TReDS, ITFS platforms have more expansive geographical coverage and more product offerings. As such, their potential for exponential growth is immense.

Trade finance professionals anticipate that the ITFS platforms will grow more successful. Some of the reasons are:

- The widespread adoption of platforms and marketplaces in all formats across the globe.

- Enabling laws passed in different countries aligning with the Model Law on Electronic Transferable Records (MLETR) to fully digitise vital trade documents (like bills of exchange, promissory notes, and bills of lading).

- Platforms and marketplaces that operate in multiple legal jurisdictions will help drive further adoption of MLETR in various countries.

- More than 80% of cross-border trade today is on an open account basis. With the implementation of MLETR, these trade transactions will become much more fundable by financial institutions than they are today.

- Platforms and marketplaces provide unparalleled convenience of access in terms of geography, timing, interoperability, and ease of operation.

- ITFS platforms are operated under strict monitoring by financial regulators, which enhances their credibility.

- Access to the central registry makes platforms safer for financiers.

Despite the optimism, a few challenges persist for the ITFS platforms, including an absence of uniform stnadards and regulations for open account transactions. Since funds are settled outside the platform, high turnaround times also pose a problem; as does awareness creation, and concerns of data privacy.

Nonetheless, it is believed that ITFS platforms will benefit from network effects, leading to value creation for participants and expansion of the market.

The adoption of MLETR, increased volumes for open account trade, interoperability, seamless integration capability, ensured liquidity, transparent regulations, the possibility of tokenisation and secondary market operations will all make platforms like ITFS the future of global trade finance. These developments will be exciting to watch in the coming years.

– Kalyan Basu is the MD & CEO of Vayana (IFSC) Pvt Ltd., the company which built and operates the Vayana TradeXchange (VTX), an ITFS (International Trade Financial Services) platform for facilitating the financing of Cross Border Trade globally, established as per the guidelines issued by IFSCA (International Financial Services Centre Authority at GIFT City, Gujarat).